Scala Blockchain

FintechBlockchain for Fintech(Financial technologies)

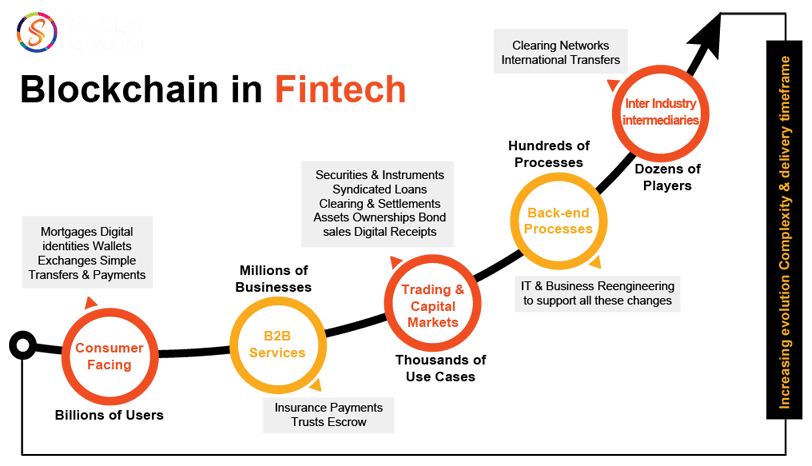

Blockchain is disrupting the financial sector from operations to retail. AI (Artificial intelligence) to augmented reality, fast paced advances in technology are redesigning the financial services landscape, creating not just opportunities, but also challenges for customers, service providers, and regulators. With the global finance being localized and accessible; cross border transaction are becoming the need of the hour. Using blockchain as an economic framework, fintech might provide new solutions that respond to consumer needs for security, trust, better services, privacy and transform the competitive landscape.

Blockchain and financial services- What’s new?

Blockchain is likely to open new markets and encourage additional competition from non-traditional players in existing market scenario.

Cards and payments

- Interbank settlements

- Cross currency transactions

- Micro payments

- Loyalty programs

Capital markets

- Smart bonds

- Equity issuance

- OTC derivatives

- Repurchase agreements

Banking

- Commercial lending

- Supply chain financing

- Mortgage lending

- KYC processing

Utilities

- Document management

- Bill payment

- Asset digitalization

- Contract management

Blockchain hold potential to generate substantial and optimal benefits, firms would need to overcome significant challenges to enjoy the positive outcome, including rethinking some parts of their business models, changing the way they approach to stakeholder engagement and managing the culture change required to collaborate with external partners in blockchain network.

With the success of the cryptocurrency “Bitcoin” which is built on the blockchain technology, it is undeniable that blockchain is going to be the future in the tech industry.